1) Decide Which Car To Buy

First, decide what’s important to you. For us it’s reliability, safety and room for our cubs. For some it’s power, gas mileage, or made in America. Be as specific as you can, down to year, make, model and trim. Then you can shop right comparing apples to apples.

Second, how much can you afford? Most people take a loan to buy their cars. A monthly payment of 15% or less of your pre-tax monthly income is a smart goal. A car loan calculator is a great tool to understand how loan payments are affected by purchase price, interest rate and term.

Read on….

How To Choose the Right Car For You

What’s important to you?

Different people have very different reasons for the cars they buy, and we can respect any decision that’s well thought out. While there’s lots of right ways to decide which car is right for you, there’s one wrong way: showing up at the dealership and shouting “Oh, I love the red one!” right in front of the salesman.

Step one is just like the rest of the 7 steps in our process – the more you do on your time, in your place, and outside of the dealership, the better.

What’s important to you will likely boil down to 4 factors:

Personal preference

Safety

Gas Mileage

Reliability & Repair Cost

Personal Preference

What works best for you? A sedan, an SUV or a pickup truck? Do you need all wheel drive? Do you want to buy American? These are all personal questions and there’s no right answer, but the more you can narrow down your needs before you begin your car shopping process, the better able you will be to find the best price.

Safety

We bears always like to expect the best and prepare for the worst, so our car shopping process will always begin with safety. The problem is they all look pretty safe, right? And who has the money to crash a bunch of them, try to roll them over at high speeds in a turn, and evaluate whether each of your dream car has all the latest safety technologies to avoid a crash?

Actually, there’s a good answer: the US Government. Each year, they test new cars, trucks, sport utility vehicles and vans and rate them using a 5-star safety system. Five stars indicates the highest safety rating and one star the lowest. Even better, this information is available to all of us free of charge.

To see how your car stacks up, you can use the Vehicle Comparison tool on the National Highway Traffic Safety Administration’s website. You can enter up to 3 vehicles and see your car’s safety rating, as well as whether there are any outstanding recalls. Remember, “more stars means safer cars”.

Gas Mileage

At about $1,615 per year, gas will be one of the biggest elements of the average car’s operating cost so it makes sense to think through your car’s fuel efficiency for the sake of your pocketbook. (Leaving aside a discussion about carbon emissions, climate change and the like.)

Here’s how gas mileage can affect the bottom line, based on the average car in the USA:

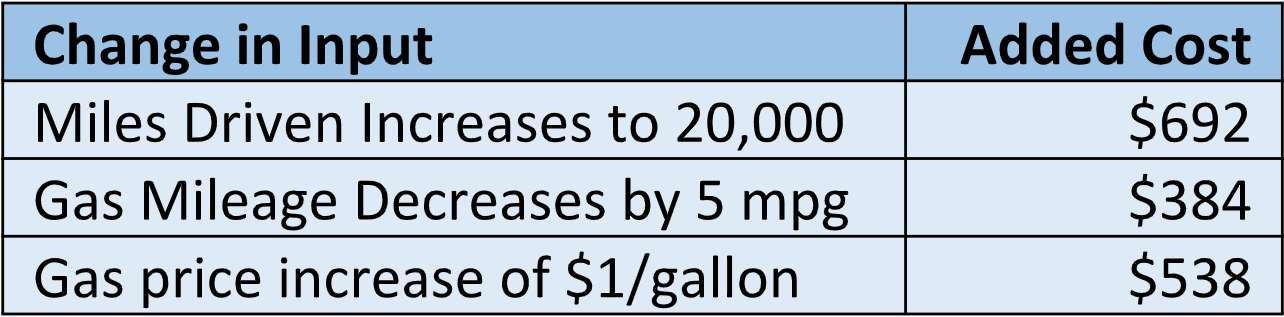

What’s more interesting is how much the $1,615 can very depending on changes to miles driven, gas mileage, and especially price per gallon of gasoline at the pump. The quick answer is that it can change a great deal, depending on some things you can control like how many miles you drive, and the gas mileage of the car you purchase—and others you can’t like the price of gas at the pump.

Reliability & Repair Cost

Unlike the average bear, we don’t’ think about reliability and repair cost separately—both are important and both are closely related. It’s not much help if you have a car that breaks down only once in a while, but when it does, it costs a ton to repair. On the other hand, it’s not much help if your car is inexpensive to repair but you’re on a first name basis with your mechanic because it’s in the repair shop all the time.

Below, we take Consumer Reports Ratings of the reliability of the average car brand and star the brands—which according to our analysis—are cheapest to repair and have better-than-average reliability ratings. Our analysis of cost to repair is based the on wholesale cost of vehicle service contracts (aka VSCs or extended warranties). Our reasoning is that the cheaper the VSC cost, the cheaper the average cost to repair.

How Much Can You Afford To Spend On Your Car?

Most people don’t have $20-50,000 sitting around to pay for a car, which is why most new cars are sold with car loans. And because cars are one of the biggest purchases most of us will ever make, car loan payments are likely to be one of the biggest budget items.

A rule of thumb for car loan payments is that they should be equal to about 15% of your pretax monthly income. So if you earn $3,000 per month, your monthly car loan payment should be around $450. Of course, everyone’s monthly budget situation is different and you need to factor in car insurance, rent or mortgage, childcare, food, and so on.

The critical point here is that you need to lay out your household income and expenses and make sure you are meeting your savings or financial goals. And like almost all other aspects of car research, decision making and negotiating, you need to do this on your time, at your pace, in your place. Remember: The car dealership is the worst place to make important financial decisions.

To give you a sense of how much car you can afford, use our car affordability calculator. You’ll need to enter:

A down payment amount (20% of car price is a good goal)

A rough trade-in value for your current vehicle (if appropriate)

Any available vehicle rebates

The length of the loan you’d like (shorter is better with 60 months as a good goal)

How much you can afford to pay per month

What interest rate you think you can qualify for (a range is 4%-18% as your credit goes from great to poor).

So, which car is best for you?

Once you’ve understood your needs, wants, budget and the tradeoffs between them we hope you come to a good decision about the car you’d like to shop for, hopefully with make, model, year and options in mind. Now you’re ready to get some price quotes from car dealerships close to you. Bear in mind, there’s a right way and a wrong way to do this and we want to steer you right. The right way is proven to save you over $1,500 so it’s worth some explanation.